wyoming tax rate for corporations

An S-Corp can be taxed more or less but avoids double taxation. What is the federal corporate tax rate.

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax.

. Wyomings Sales and Use Tax. Wyoming residential and commercial property taxes can be. Ad Our 199 LLC formation service includes Bank Account provides everything you need.

First things first. Detailed Wyoming state income tax rates and brackets are available on this page. The tax is either 60 minimum or 0002 per dollar of.

If your business is responsible for. The current corporate tax rate federal is 21 thanks to the Tax Cuts and Jobs Act of 2017. But thats not all that Wyoming has going for it.

Because your Wyoming corporation income flows through to your personal tax return you must pay self-employment tax also known as FICA Social Security or Medicare tax on your. Ad Our 199 LLC formation service includes Bank Account provides everything you need. Additionally counties may charge up to an additional 2 sales tax.

State Assessment of Minerals. Form your Wyoming LLC with simplicity privacy low fees asset protection. Form your Wyoming LLC with simplicity privacy low fees asset protection.

State Assessment of Industrial Land. Wyoming Sales Tax. House Bill 220 creates what proponents are calling the National Retail Fairness Act which imposes a corporate income tax of 7 percent on C corporations with more than 100.

The states average effective property tax rate is just 057 10th-lowest in the US. Each year youll owe 50 to the State of Wyoming to keep your Wyoming company. 115 of Fair Market Value.

Wyoming is the least taxed State in America if you figure there is no personal or corporate income tax. An S-Corp is not taxed at the same rate as a C-Corporation which is 21 at the time of this writing. Corporate rates which most often are flat regardless of the amount of income.

A Wyoming LLC also has to file an annual report with the secretary of state. 100 of Fair Market Value. The Wyoming income tax has one tax bracket with a maximum marginal income tax of 000 as of 2022.

This will cost you 325 for a corporation or an LLC. Wyoming charges a sales and use tax of 4 for which you will need a license to collect if you sell physical goods andor provide certain types of services. The state of Wyoming charges a 4 sales tax.

We include everything you need for the LLC. The annual report fee is based on assets located in Wyoming. The sales tax is about 542 which.

Up to 25 cash back Tax rates for both corporate income and personal income vary widely among states. Likewise the states average sales tax. What is the Wyoming corporate net income tax rate.

Effective July 1 2021 there will be an increase from 12 to 20 in the collection fee on SalesUse Tax Accounts that have been referred or will be referred to an external. Prior to the Tax Cuts and. Wyoming also does not have a corporate income tax.

Wyoming Sales Tax Small Business Guide Truic

Ohio Politicians Push Regressive Tax System While Shedding Crocodile Tears Over Inflation Ohio Capital Journal

Pooja Crahen Pooja Gandhi On Twitter Tax Haven Corporate Tax

Corporate Taxes By State In 2022 Balancing Everything

New York State Enacts Tax Increases In Budget Grant Thornton

How Do State And Local Individual Income Taxes Work Tax Policy Center

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

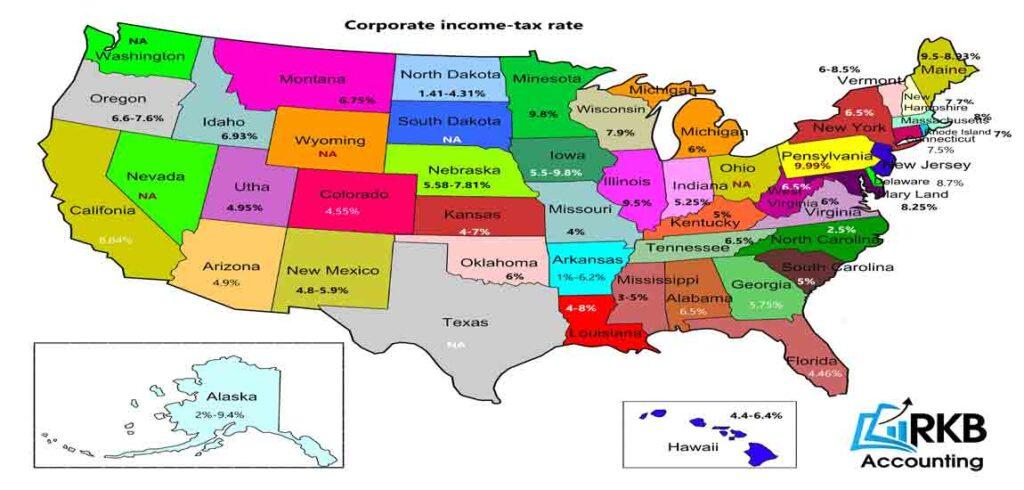

Which State Has The Highest Corporate Income Tax Rate Accountingweb

State Corporate Income Tax Rates And Brackets Tax Foundation

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Business State Tax Obligations 6 Types Of State Taxes

How Do State And Local Sales Taxes Work Tax Policy Center

U S Corporate Tax Rates Rkb Accounting Tax Services

Corporate Tax Reform In The Wake Of The Pandemic Itep

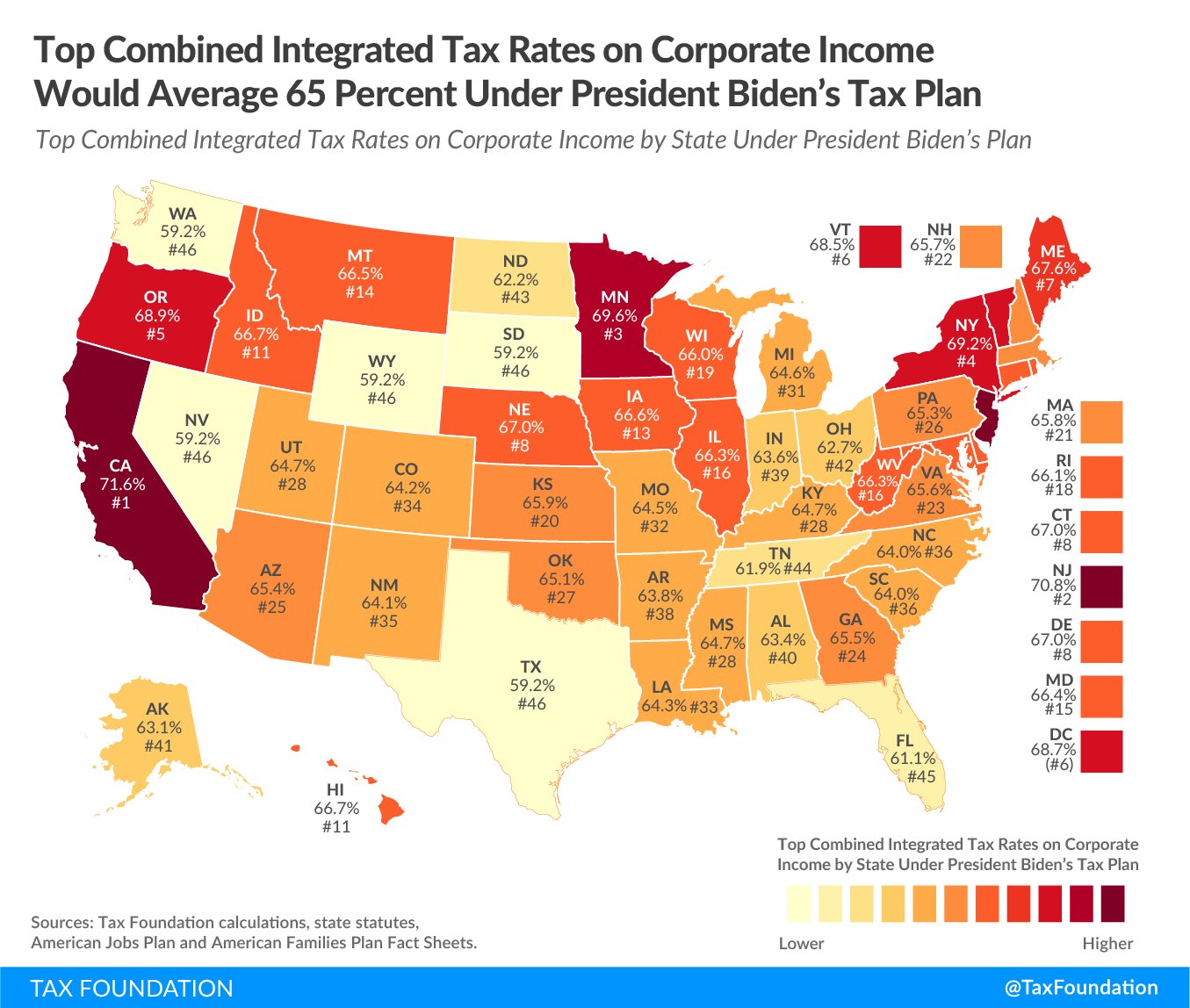

Tax Foundation On Twitter Under Biden S Tax Plan 45 States Would Have A Top Combined Integrated Tax Rate On Corporate Income At Or Above 60 71 6 Ca 70 8 Nj 69 6 Mn 69 2

How Do Corporate Taxes For Small Businesses Vary Around The World Vivid Maps

Corporate Tax Rates By State Where To Start A Business

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation